unrealized capital gains tax bill

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis.

The proposal adds a 20 minimum tax on the unrealized capital gains for households worth at least 100 million a political win for progressives who have been pushing Biden to target the mega-wealthy.

. President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. At the current top capital gains tax rate of 238 percent the tax bill on a 3 billion gain would be 714 million spread over five years. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains.

If the business appreciates by 5 percent this year then the owner would have an additional 10 million of unrealized gains. This tax called a billionaire minimum income tax would impose an annual 20 percent tax on taxpayers with income and assets that exceeding 100 million a 360 billion tax increase. If it passes what is the point in investing in the.

House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill. President Biden Unveils Unrealized Capital Gains Tax for Billionaires. Prohibition on the implementation of new federal requirements to tax unrealized capital gains.

The plan will be included in the Democrats US 2 trillion reconciliation bill. How might it change the best investment strategies. A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill.

It has already been a long year of new taxes tax hikes and even more tax proposals. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. Unrealized gains Before we jump into what an unrealized gain is you need to understand what a realized gain is.

Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. The proposal which is being reviewed by Senate Finance Committee Chairman Ron Wyden D-Ore would impose an annual tax on unrealized.

Unrealized capital gains are increases in value of stock purchases. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. President Bidens Fiscal Year 2023 budget includes a new tax on unrealized gains.

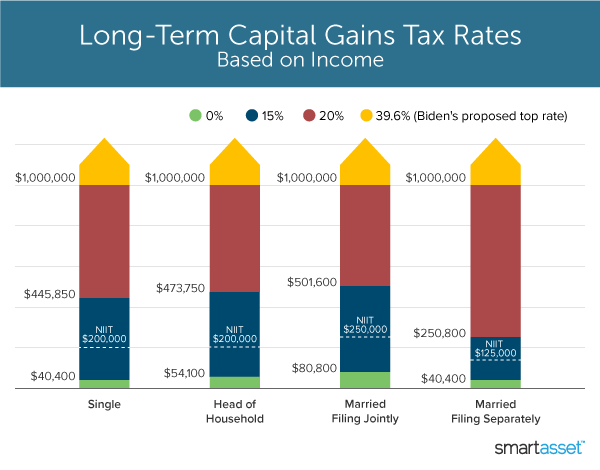

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. Households worth more than 100 million as part of his budget proposal. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains. Or if the billionaire used the option of treating 1 billion of stock as non-tradable 2 billion of the gain would face an immediate tax of 476 million spread over five years. October 25 2021.

These gains would be added to the owners regular income to form the tax base of the new minimum tax. House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on wealthy peoples unrealized capital gains.

In reality it is a tax on wealth. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation on unrealized capital gains from any taxable asset including but not limited to. This tax is just the latest attempt by the Democrats to reshape the tax code and pass a tax on.

Scrapping that tax on unrealized capital gains would primarily benefit the richest Americans who hold the bulk of the countrys financial wealth. If the proposal were to pass billionaires. Sarah SilbigerBloomberg via Getty Images.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains.

Capital Gains Tax What Is It When Do You Pay It

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

High Class Problem Large Realized Capital Gains Montag Wealth

Tax Strategies Using Nua For Modestly Appreciated Stock

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Incentive Management

Capital Gain Calculator Estimate The Tax Payable Scripbox

What S In Biden S Capital Gains Tax Plan Smartasset

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Quicken2017 New Features Ableton Live Investing Accounting Software

Biden S Better Plan To Tax The Rich Wsj

The Sorry State Of Risk Tolerance Questionnaires Tolerance Financial Advisors Assessment Tools

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Pin On Retirement Financial Planning

Bitcoin Gains Can Become Tax Free Investing In Cryptocurrency Cryptocurrency Bitcoin

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)